regional income tax agency estimated payments

RFP Invitation - Network Intrusion Prevention System Solution. Of estimated tax payments and credits on your account or make a payment by.

Individual Estimated Income Tax andor Extension of Time to File.

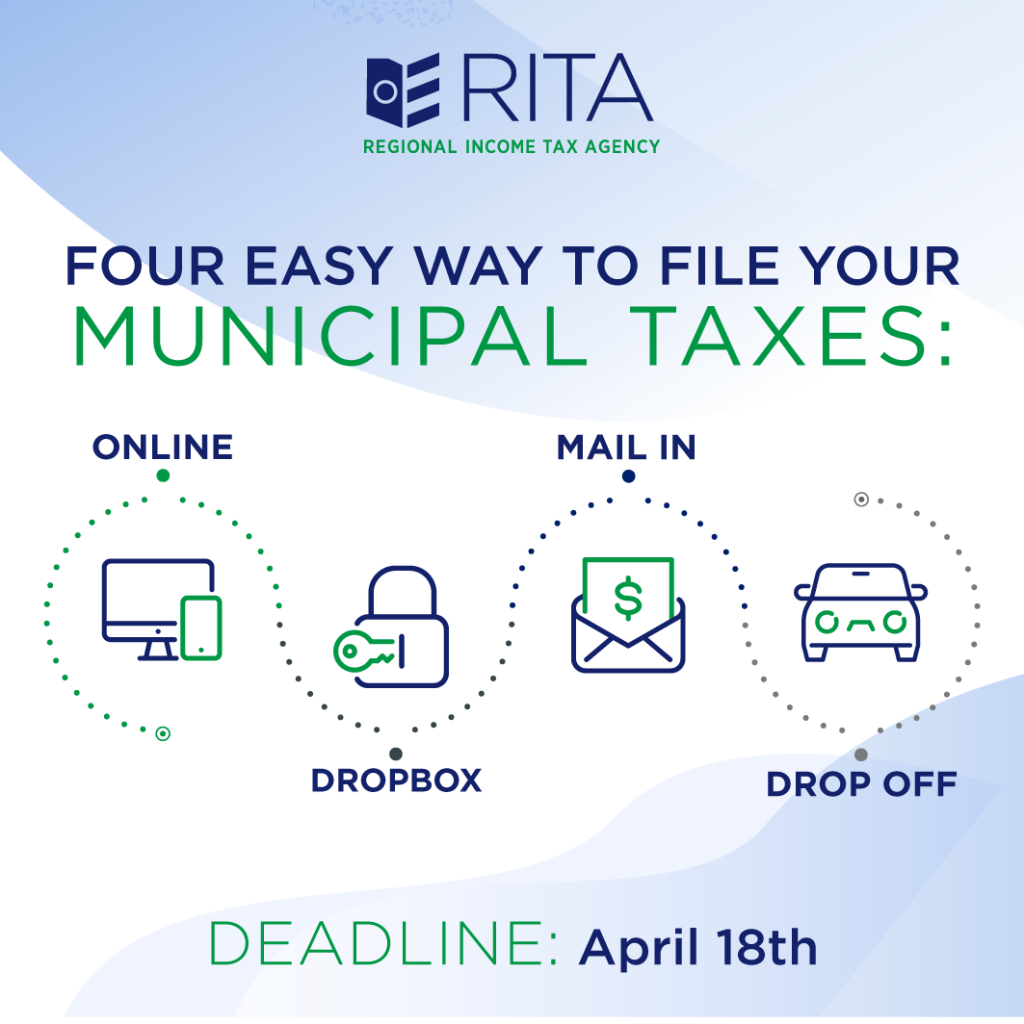

. Self-service phone options - making a payment checking refunds and estimates - available 247. RITA offers the following payment options. 5 REGIONAL INCOME TAX AGENCY Net Profit Estimated Income Tax andor Extension of Time to File.

Use your prior years federal tax return as a. Estimated payments may be required if you have taxable income in an Ohio municipality that is not subject to withholding if you have business income in an Ohio municipality andor if. Extension of Time to File.

Extensions of time to file have no effect on the due dates of the 2020 estimated taxes. B that tax is collected by the regional income tax agency rita owned by over 200 municipalities in ohio. If you file on an extension your first 2020 estimated tax payment is still due April 15 2020.

REGIONAL INCOME TAX AGENCY REGIONAL INCOME TAX AGENCY. File your taxes make a payment check your refund status view payment history or send RITA a secure message. Effective July 1 2019 the Regional Income Tax Agency RITA began collecting municipal income tax for the City.

When figuring your estimated tax for the current year it may be helpful to use your income deductions and credits for the prior year as a starting point. Income Tax Finance Director City Of Elyria Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. If your city or municipality collects.

Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Each of those municipalities sets the regional income tax. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year.

Request for Allocation of Payments. Analysis findings for No Regional ompetition Scenario presents the findings of the analysis including tables that summarize projected 2017-2021 non-property tax revenues for a low-revenue case an average-revenue case and a high-revenue case as well as estimated annual PILOT revenues for the same time period. Use your prior years federal tax return as a.

If youd like a CCA team member to complete your municipal income tax return please fill out the CCA Division of Taxation Taxpayer Assistance Form found on the Tax Forms page of this website. Form 32 EST-EXT. Ifyou file on an extension and you expect to owe estimated taxes for 2020 remit your first quarter estimated payment with Form 32.

D wages salaries commissions tips fees sub pay bonuses incentive. As an employee at Regional Income Tax Agency in the USA you can expect to earn an average salary of 35191 per year or 1692 an hour. Salary information comes from 53 data points collected directly from employees.

DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. The Department of Finance DOF administers business income and excise taxes. Delivery options for this form are found on the bottom of the first page.

Checking or Savings Account. Request for Allocation of Payments. Form 10A Application for Municipal Income Tax Refund.

This tax goes by different names depending on whether youre a resident a business owner or an individual who works in one of them. Regional Income Tax Agency Estimated Payments. Beginning with tax year 2016 Ohio law requires you to make estimated municipal income tax payments.

Estimated Payment not less than 14 of Line 3 00 Note. Estimated payments may be required if you have taxable income in an Ohio municipality that is not subject to withholding if you have business income in an Ohio municipality andor if you owe residence tax to the municipality where you reside. Use the message center to send us a secure email.

The Regional Income Tax Agency collects income taxes for many Ohio municipalities which the agency lists here. RITA PO Box 477900 Broadview Heights OH 44147 - 7900. The Regional Income Tax Agency collects income taxes for many Ohio municipalities which the agency lists here.

Take a look at our open positions. Take a look at our open positions. The lowest-paid workers at Regional Income Tax Agency make less than 17000 a year while the highest.

Payments made by check or via ACH will not incur this service charge. The Act would result in new revenue for all regions of the State. Ten percent of the States tax revenues will be split equally between host municipalities and host counties.

C rita is a public agency that operates under state rules and regulations that mandate strict privacy policies for handling tax forms and information. RITA PO Box 477900 Cleveland OH 44147 - 7900. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online.

Municipal Income Tax Drop-Off Sheet. RITA PO Box 95422 Cleveland OH 44101 - 0033. View options to manage your account online at MyAccount.

CLEVELAND OH 44101-2004 BROADVIEW HEIGHTS 44147-7900. Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Use this form to allocate existing paymentscredits between separate individual accounts.

Visa Master Card or Discover Card Please note that a 275 Service Charge will be added to payments made by credit card. Payments made by check or via ACH will not incur this service charge. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate.

There is a significant gap between the bottom 10 percent of earners and the top 10 percent of earners. 5 Regional Income Tax Agency Estimated Income Tax andor. Form 32 EST- EXT Estimated Income Tax andor Extension of Time to File.

The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on page 8 of these instructions. Businesses - Payment Options - Regional Income Tax Agency. As defined by the statute 80 percent of the States tax revenues will be used statewide for elementary and secondary education or property tax relief.

To pay your tax balance due.

How To Fill The Fragebogen Zur Steuerlichen Erfassung

Income Tax City Of Gahanna Ohio

City Income Tax North Canton Oh

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

![]()

Individuals Estimated Tax Payments Regional Income Tax Agency

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Income Tax Finance Director City Of Elyria

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Individuals Filing Due Dates Regional Income Tax Agency

11 01 21 Beta Bit Estimated Tax App App For Taxpayers Mof Information On Covid 19

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained